We specialize in all personal and small business income tax returns.

Our team handles all state returns in the United States.

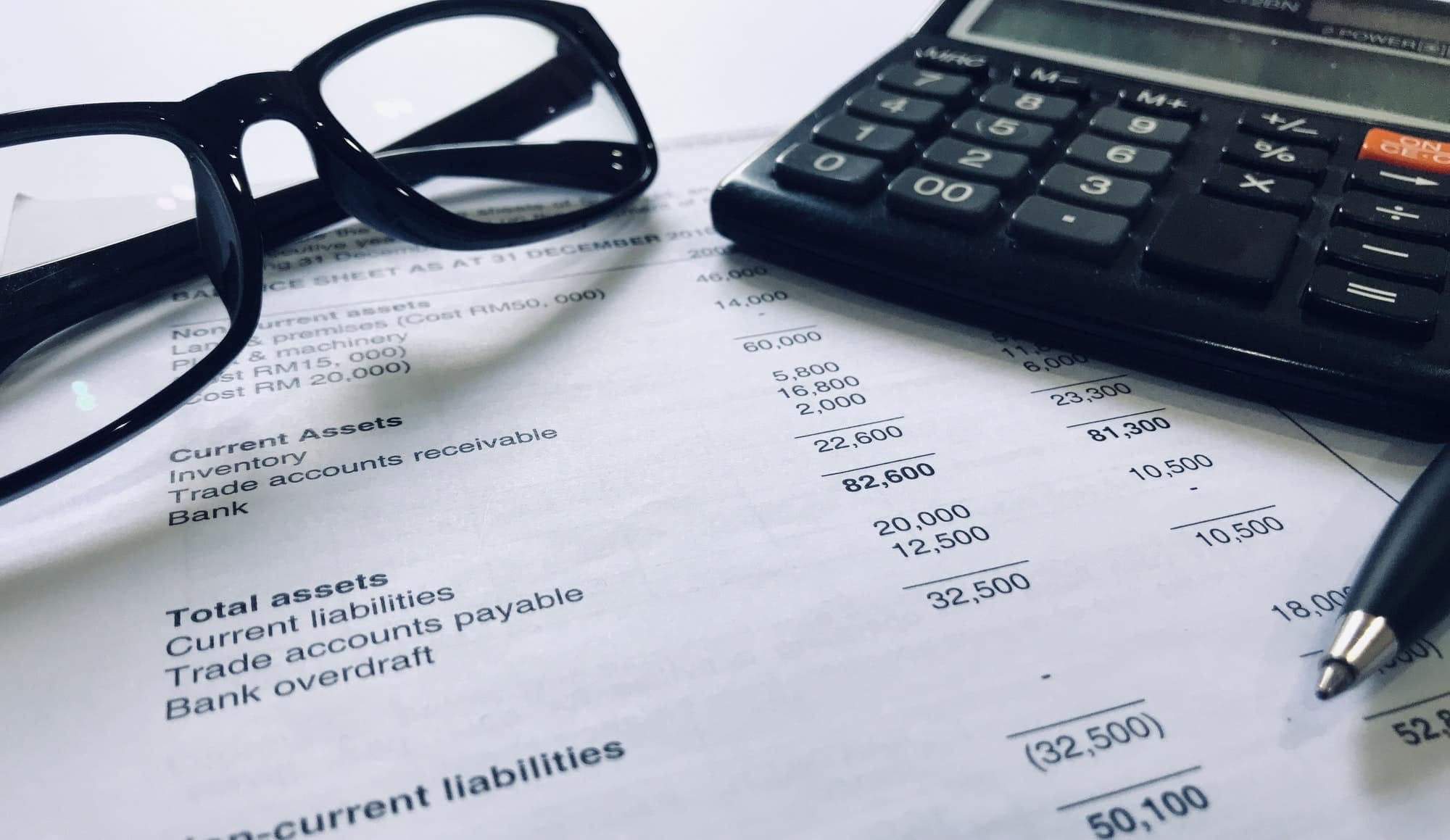

IMPORTANT DATES

Deadline for Employers to send W-2s & 1099s

Filing Deadline for 2023 Taxes

Deadline for Extension Filers

IMPORTANT DATES

Deadline to send W-2s & 1099 forms out

Taxes due for Partnerships, MM LLCs & S-Corps

Taxes due for C-Corps

With our professional services, you can rest easy knowing that your finances are in competent hands who understand the task at hand. Our team of experts has years of experience ‒ not only in poring over complex regulations but also understanding what kind of opportunities exist for you under each scenario.

Whether it’s figuring out filing schedules or executing a new financial strategy, we have both the skillset and proven track record to handle any challenge.

Easy to use, secure and the fastest way to get started.

Use our secure form to upload all the documents we require to complete your tax return.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo dolore magna aliqua erat libero condimentu.

On average we will have your complete return done in 5-7 business days.

Our scheduling team will reach out so we can review the money you are saving and ensure everything looks great to you.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo dolore magna aliqua erat libero condimentu.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo dolore magna aliqua erat libero condimentu.

This year our client's will be able to participate in our Vacation Giveaway!

Last year we ran an internal study to see how much money our first-time clients saved on their 2022 tax returns compared to what our competitors did for them in 2021.

All you need to do is fill out our Tax Application and our amazing team will get back to you once we have reviewed your application and we will start getting you serviced

Here are some common answers about our company & the 2023 Tax Season

Yes, our office is based out of Las Vegas, NV, but we are licensed to provide service in all 50 US States. From Maine to California we have worked with each state personally when servicing our clients.

We handle returns from personal W2s & 1040s to complex business returns and everything in between.

Purchased and sold rental properties?

We can handle that.

Make a lot of money in the stock market?

We can handle that.

Did you buy 3 cars, a house, and sold 2 motorcycles?

No problem.

Did your business receive a large investment that then had to be leveraged to purchase equipment & hire employees & now you also need to figure out payroll & health insurance?

Come on in.

It truly depends on the complexity of your return. For simple returns such as just one Single Filing W2 is only $300. A complex return of an individual that may have multiple 1099s, just purchased their family home, has Capital Gains Tax from making money in crypto and has a Tax Deffered Account…well they would probably start around $700, but with our experts save more than they spend.

This is truly our bread & butter. Our vast experience in SMBs allows us to ensure that your business is maximizing the possible credits that are available. A business return typically starts at $800 and goes up based on complexity.

Choosing Fintech Umbrella for your tax services offers several advantages over using software solutions like TurboTax, particularly due to the personalized, expert-driven approach we provide:

Customized Tax Strategies: Unlike TurboTax, which relies on generic algorithms, Fintech Umbrella provides personalized tax planning and strategies tailored to your unique financial situation, ensuring you maximize your tax savings.

Comprehensive Audit Support: In the event of an IRS audit, our team of experts stands by your side, offering direct support and guidance, which is beyond the scope of what TurboTax can provide.

All-inclusive Service: We handle all types of tax situations across all 50 states, offering a one-stop solution for tax prep, planning, and resolution, making the process seamless compared to the self-guided nature of TurboTax.

Human Touch: Our professionals understand the nuances and complexities of tax laws, providing clarity and peace of mind that a software program cannot match, especially for complicated tax situations.

Ongoing Support: Beyond tax season, Fintech Umbrella offers year-round support for tax questions and financial planning, ensuring you’re always prepared and informed.

By choosing Fintech Umbrella, you’re not just filing taxes; you’re investing in a partnership that aims to optimize your financial health and ensure compliance with a personalized touch.

This session is your gateway to personalized financial advice tailored to your unique needs and goals. Whether you’re navigating tax planning, seeking business growth strategies, or planning for your future wealth, our expert consultants are here to listen, understand, and provide actionable insights. It’s more than just a consultation; it’s the first step towards achieving your financial aspirations with a trusted partner by your side.

Yes we are! Be sure to ask your Tax Professional about it to get all the details!

Getting started with Fintech Umbrella is straightforward and designed to cater to your convenience. Here’s how you can begin:

Call Us: Reach out to us directly by phone. Our friendly team is ready to take your call, discuss your needs, and guide you through our process.

Email Us: Prefer writing? Send us an email at [email protected] with your inquiries or to request more information. We’ll get back to you promptly to address your needs.

Online Tax Application: For a streamlined start, visit our Tax page at https://fintechumbrella.com/tax-preparation/ and fill out our Tax Application. It’s a simple way to provide us with the information we need to begin tailoring our services to your requirements.

Whichever method you choose, Fintech Umbrella is committed to providing you with expert guidance and personalized service to meet your financial goals.

ExcellentBased on 53 reviews Scotty TregellasApril 15, 2024Recently moved to vegas/Nevada and was behind 3 years with multiple businesses. I was able to connect with Fintech, and I'm extremely grateful that I did. The team was great, and took care my wife, myself and all of my companies.Cameron HughesMarch 8, 2024Always professional and a pleasure to work with.Tanner FrigaardMarch 1, 2024Fintech has helped me and several of my friends in the past few days! I am so thankful for their guidance and education as I continue to grow my business! I would highly recommend it!!John HFebruary 7, 2024Dane and Josh at Fintech Umbrella took the time to understand the specifics of my finances and tax position. They recommended sensible and reasonable actions to improve our overall financial outlook, and we saw immediate results. I intend to recommend them to friends for tax preparation and wealth management.Mike AndrewesNovember 2, 2023Great business to work with for accounting, life insurance, bookkeeping, and more. You can quickly tell they care deeply about their clients and delivering value on a regular basis.Brittani PrengerMay 2, 2023Parrott and Associates got me back WAY more in my tax return than any other option that I was exploring. They got my taxes done fast and efficiently. I highly recommend them if you are looking for professionals who care about their clients.Liliya MarinovaApril 11, 2023Joshua was awesome and I appreciate his friendly and professional approach throughout the process!Ben DensmoreMarch 14, 2023Best tax pros ever! Filed my LLC N my personal taxes perfectly ! I’ll never go anywhere else for my taxes again! Screw hr block n turbo tax!Freddy CerpasFebruary 25, 2023Great service, very knowledgeable and explained everything in detail. Answered every question and more, highly recommended for your financial needs!!!Travis SuzukiFebruary 23, 2023Fully welcoming and Professionally done. Thanks so much P&A... much Alohas!

Scotty TregellasApril 15, 2024Recently moved to vegas/Nevada and was behind 3 years with multiple businesses. I was able to connect with Fintech, and I'm extremely grateful that I did. The team was great, and took care my wife, myself and all of my companies.Cameron HughesMarch 8, 2024Always professional and a pleasure to work with.Tanner FrigaardMarch 1, 2024Fintech has helped me and several of my friends in the past few days! I am so thankful for their guidance and education as I continue to grow my business! I would highly recommend it!!John HFebruary 7, 2024Dane and Josh at Fintech Umbrella took the time to understand the specifics of my finances and tax position. They recommended sensible and reasonable actions to improve our overall financial outlook, and we saw immediate results. I intend to recommend them to friends for tax preparation and wealth management.Mike AndrewesNovember 2, 2023Great business to work with for accounting, life insurance, bookkeeping, and more. You can quickly tell they care deeply about their clients and delivering value on a regular basis.Brittani PrengerMay 2, 2023Parrott and Associates got me back WAY more in my tax return than any other option that I was exploring. They got my taxes done fast and efficiently. I highly recommend them if you are looking for professionals who care about their clients.Liliya MarinovaApril 11, 2023Joshua was awesome and I appreciate his friendly and professional approach throughout the process!Ben DensmoreMarch 14, 2023Best tax pros ever! Filed my LLC N my personal taxes perfectly ! I’ll never go anywhere else for my taxes again! Screw hr block n turbo tax!Freddy CerpasFebruary 25, 2023Great service, very knowledgeable and explained everything in detail. Answered every question and more, highly recommended for your financial needs!!!Travis SuzukiFebruary 23, 2023Fully welcoming and Professionally done. Thanks so much P&A... much Alohas!

Lorem ipsum dolor sit amet, contur ading elit. Ut elit tellus, luctus nec.

Lorem ipsum dolor sit amet, consectetur adipisci elit, sed do eiusmod tempor.

Pursuant to NRS 240A.150, Registrant, NVDP20202274129, is NOT an attorney authorized to practice in the State of Nevada and is prohibited from providing legal advice or legal representation to any person.

© 2024 Fintech Umbrella LLC All Rights Reserved